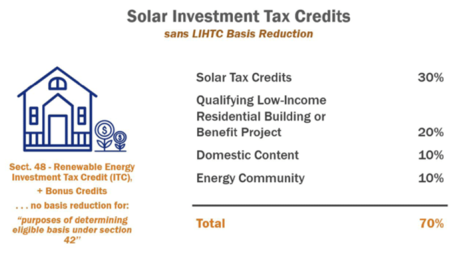

Clean energy provisions in the Inflation Reduction Act (IRA), signed into law in August, provide significant additional incentives to install solar panels on affordable housing rental properties. The magnitude of the added benefits means that every developer and owner should consider adding solar to their LIHTC properties, both those in service and those under development.

For more information, check out this great article from Novogradac, published by Michael Novogradac in the Novogradac Journal of Tax Credits, Volume 13 Issue 11.

Thanks to IRA, Consider Adding Solar to your Tax Credit Properties